The Opportunity

With a background in Engineering Consultancy, we had been familiar with RPS Group for many years, albeit historically their operations had been heavily Oil and Gas (O&G) focussed. They were a reputable brand with good clients and a mid-tier headcount.

Why we invested

We only became interested in RPS as an investment, however, when a new management team were appointed and they diversified their services to more traditional engineering sectors.

Our own research from M&A deals in this sector showed that most consultancy business were acquired for around 0.75 – 1 x sales and it was therefore probable that at some point RPS would be acquired by a larger peer at a similar multiple.

We decided that if an opportunity therefore arose to buy RPS shares at 0.5 x sales or cheaper we would act.

Our Investment Approach

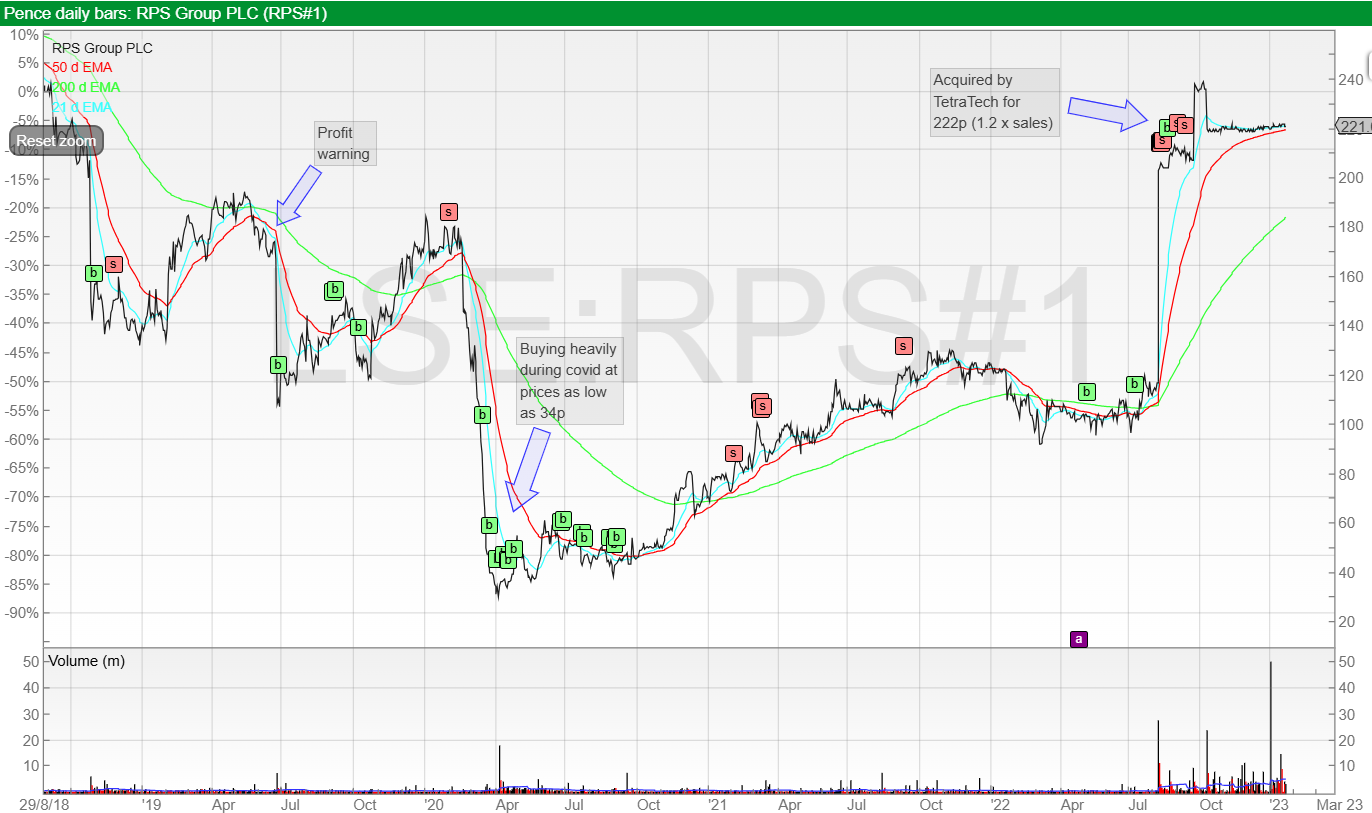

This opportunity came in June 2019 following a short-term profit warning and we bought a medium sized holding in June 2019 at just over 98p.

What Happened

What we hadn’t seen coming was Covid. By April 2020 the share price was 30p. If an investor could look beyond Covid, this was a generational opportunity. We bought heavily at prices as low as 34p. The Price/Sales ratio was just 0.15x.

Outcome & Return

In August 2022, a bidding war between Tier 1 peers WSP Group and TetraTech ended with RPS being acquired by TetraTech for 222p (1.2 x Sales).

Our total return (TR) including dividends was 224% in just over 3 years; a CAGR of 43.5%.