The Opportunity

We first met the management of National Milk Records (NMR) at an investor event in Derby in 2018 and warmed to their quirky and affable CEO/MD Andy Warne.

NMR had a very interesting moat by means of a leading milk recording and dairy software service along with a milk testing laboratory (NML) who received 98% of dairy milk samples in the UK.

They were also developing a genomics offering and had recently decoupled themselves from the burden of the long-standing Milk Pension Fund (MPF) in June 2017 whilst also doing a fund-raise.

Why we invested

Our investment thesis was that the business generated cash, had good gross margins, and had an opportunity to leverage its unique position and customer base in growing its genomic platform. A new management team were also in place with an ambition to significantly grow the business.

Our Investment Approach

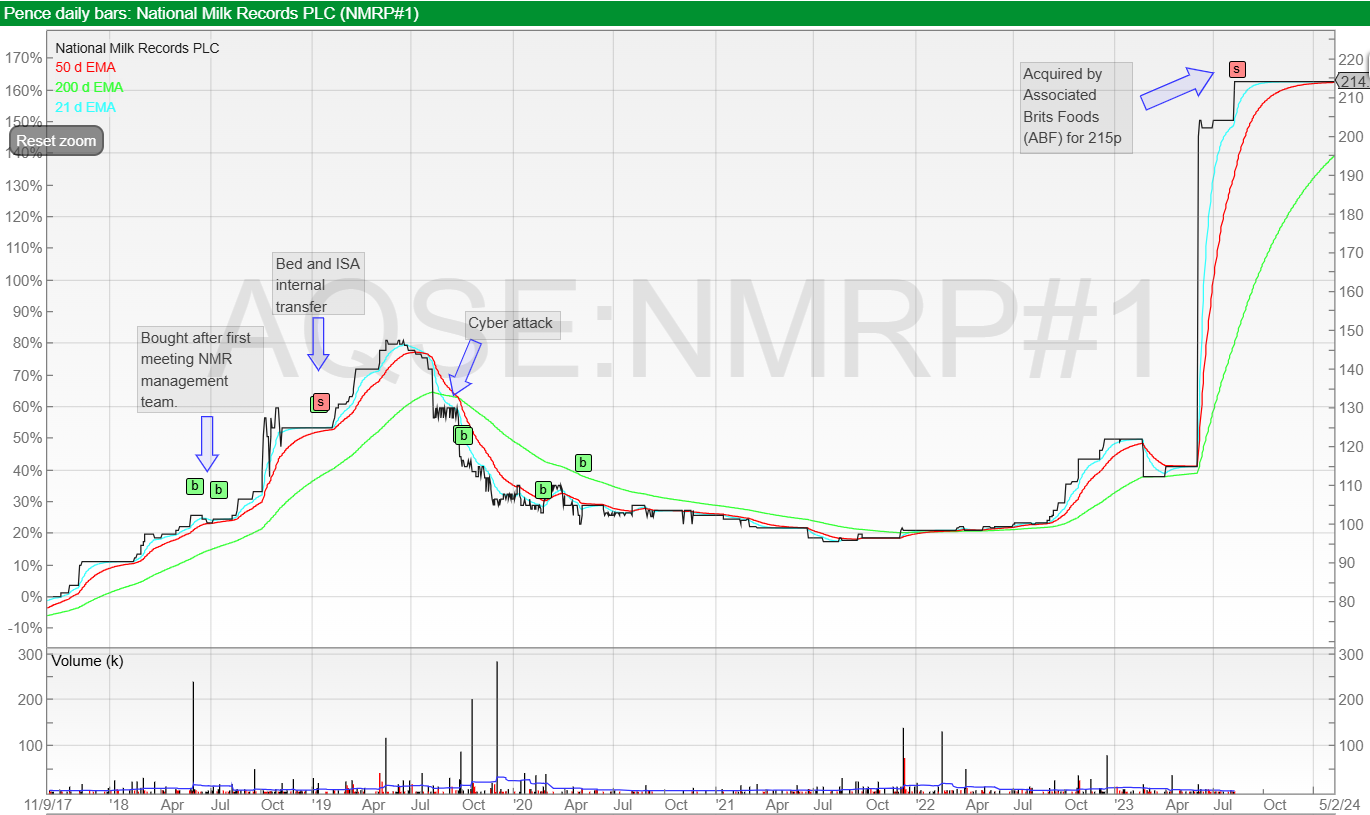

We initially bought shares at 100-101p in June/July 2018 and following a disruptive but luckily short term cyber-attack we bought more shares in 2019/20 at prices up to 117p.

What Happened

After recovering from the cyber-attack, the business started to deliver the expected improved financials and in June 2023, Primark owner Associated British Foods (ABF) acquired NMR for 215p/share or £48m.

Outcome & Return

Our total return (TR) including dividends was 103% over 5 years, a CAGR of 15.2%.