The Opportunity

Haynes Publishing Group plc (“Haynes”) was a brand we had been aware of since the 1980’s, known for their superbly detailed automotive repair manuals.

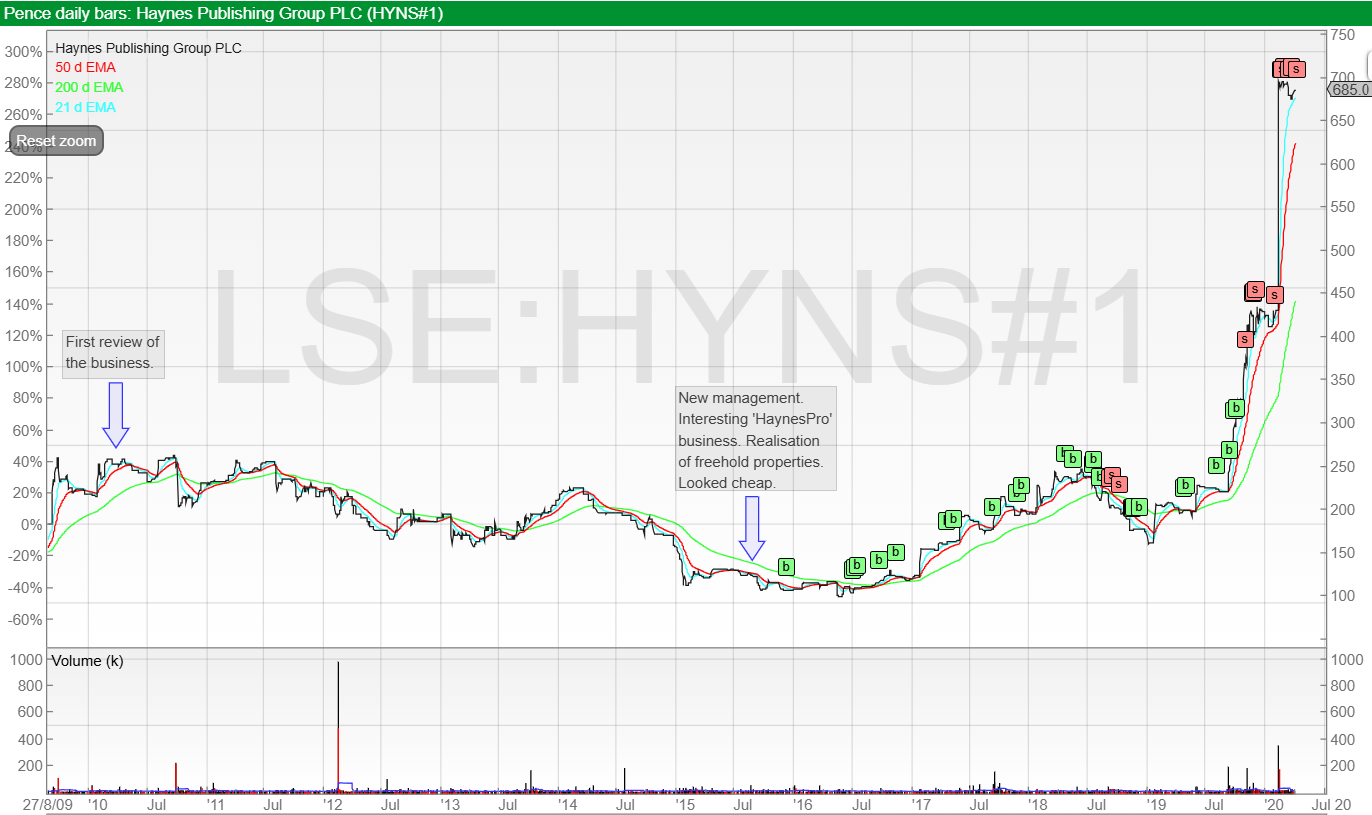

We initially reviewed the business as a potential investment in 2009/10 due to their strong brand, but at that time we were not keen on the management team or executive pay, automotive repair manuals were in slow decline and there wasn’t much to get excited about.

Why we invested

We didn’t revisit the business again until 2015, by which time the share price had fallen by 50% from 250p to 125p.

Now there was a new management team in place led by the founder’s son J. Haynes, they had an excellent ‘HaynesPro’ data business that was growing rapidly and was under-the-radar, and their balance sheet included several valuable freeholds. The brand also remained strong.

Our Investment Approach

Valued at a discount to book value and delivering high gross margins with a growing HaynesPro platform, we made our first purchases of the shares at 107p in December 2015, and we continued to buy up to 285p in September 2019 following attendance at several AGMs and becoming more familiar with the business.

What Happened

As expected, the HaynesPro business grew rapidly and as it became more appreciated by the market, we reduced our position at 420p in January 2020 but retained a core holding.

Outcome & Return

We were delighted that Haynes was subsequently acquired a month later for 700p by InfoPro Digital Group.

Our total return (TR) during the circa 4 year holding period was 246%, a CAGR of 35.5%.